State aid Scoreboard 2022: Level playing field in the EU is challenged

State aid expenditure keep increasing in the EU. The amount of state aid disbursed are also very uneven between different Member States. As the European Commission publishes its yearly state aid scoreboard, there is cause for concern regarding the integrity and functioning of the Single Market.

As one of our five priorities for the Swedish presidency, Swedish Business has highlighted the need to strengthen and deepen the internal market. A basic prerequisite for a well-functioning internal market is that companies can compete on equal terms. In our report A competitiveness compass for the EU we highlight that further erosion to EU state aid rules will have a negative impact on competitiveness and productivity. Young and productive companies may have to leave the market in favour of less productive ones receiving government support.

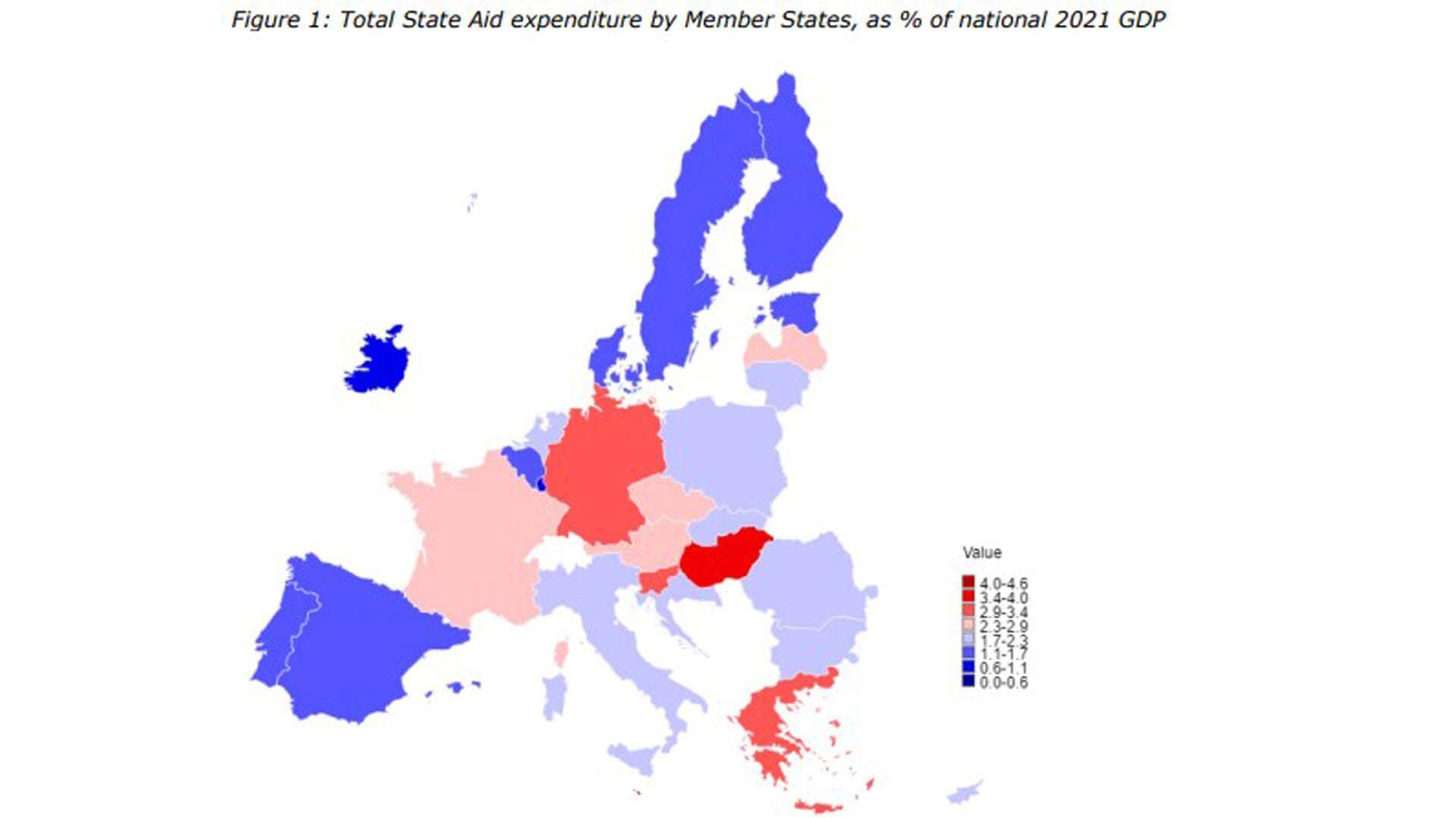

The Commission report shows the amount of state aid that ultimately was paid out from EU Member States to specific companies during 2021. The amount of government support increased significantly in 2020 due to the pandemic. Also in 2021, Member States paid out a large amount of aid to rescue companies hit by the crisis. The fact that the total amount of State Aid remains at record levels is not surprising. The aid amounts amount in total to around 335 billion Euro, or 2,3 percent of EU GDP.

The Commission’s report on State Aid expenditure gives cause for concern when comparing different Member States. As the Commission states, there is a significant spending dispersion across Member States. Those spending the most spend around 3.4-4.6 percent of their national GDP (Malta, Hungary and Germany), while the Member State spending the least, spends around 0.9-1.4 percent of GDP (Ireland, followed by Luxembourg, Sweden, Belgium, Portugal and Denmark).

– This shows the importance of returning to a stricter state aid regime, says Göran Grén, Head of Business Policy and Law Division at the Confederation.

– The statistics clearly show that the fears we have had about how competition in the internal market risks being distorted were justified. This is harmful to the Single Market and can hit individual companies when their close competitors receive large state subsidies.

The Commission have also stated the risk of opening up the State Aid rules further, recently as the Temporary Crisis Framework was revised into a Temporary Crisis and Transition Framework.

– The figures mentioned in those cases are also valid and concerning. They however refer to granted aid, which differ from how much aid is paid out in the end. Now that we have the figures for 2021, we can conclude that there are real differences between how the countries support companies. And considering that the rules have been opened up since 2021, there is a risk that the differences have increased even more since then, Göran Grén concludes.